Forkonomics & Why Nerite chose to be a friendly fork of Liquity V2

Spoiler alert: it was the easiest choice we ever made.

Forkonomics

Forkonomics is like economics, but for forks. Since all the code for most Defi protocols is open source we see new teams “fork” existing popular code, make their own changes, and launch their own protocol “forks” all the time.

Brief History of DeFi Forks

Every time there has been a hugely successful DeFi protocol, like Uniswap, Aave, or Liquity, it gets copied dozens or even hundreds of times. Each copy might make its own improvements that support a specific use case, or make no changes at all and just launch the same code on a new network. Sushiswap famously forked Uniswap and added a native token and deployments on more networks not supported by Uniswap. Lybra forked Liquity, a powerful stablecoin protocol that only supported ETH in its V1, and added support for yield bearing wstETH.

DeFi Llama even has a whole data dashboard on DeFi Forks: https://defillama.com/forks

Liquity Forks of the past

According to DeFi Llama, there’s been at least 36 forks of Liquity. Several of them have collapsed, despite Liquity being rated the safest stablecoin protocol ever created, due to security issues or accepting bad collateral, losing investors and users millions of dollars. Ouch! How could building on top of the safest code ever for creating stablecoins lead to such ruin? It’s a huge problem.

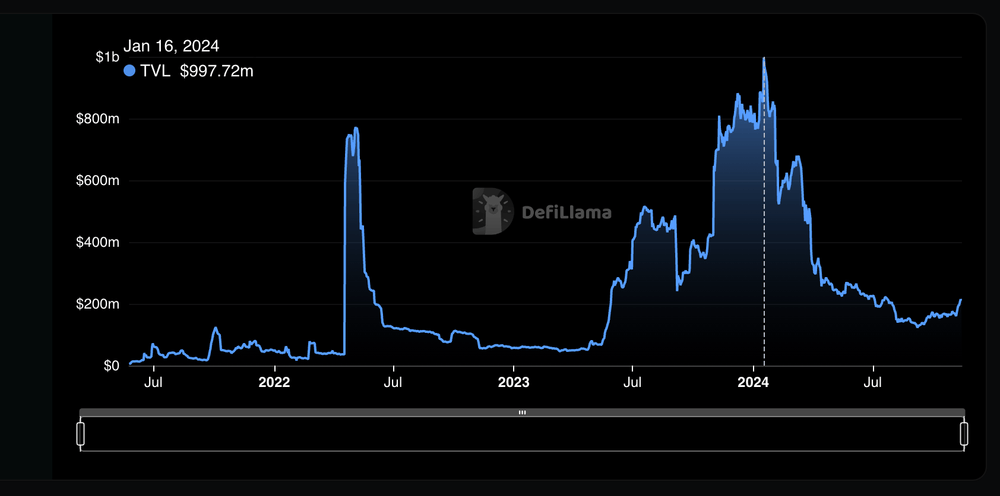

Liquidity might have an incredible security team, the most brilliant Solidity developers, and great audits, but every team forking their open source code does not necessarily have the same level of skill or funding for security audits, etc.. At the same time, Liquity forks had more than $997M USD of TVL at their peak, but none of that success was passed along to LQTY holders, or the Liquity devs, or security teams. How could the Liquity team support forks better and prevent hacks when they are not benefiting from the success of those forks?

So there’s a two fold problem in how most forks are being created today:

Hacks and major problems happen more often to forked projects who may make mistakes deploying the code safely or maintaining it as it was intended to be maintained.

The original teams that created the protocol have no incentive to help forks succeed and be safe.

Liquity V2 Forkonomics

Liquity Version 2 is a major upgrade to the Liquity codebase that will also launch a new stablecoin ($BOLD) when it is live. However, this code is not licensed MIT (the most common open source license) which allows anyone to modify and use it however they want. The license V2 code is more restrictive, and requires getting permission from the Liquity team to use.

This changes the game forever!

In exchange for kicking up incentives to the original Liquity project, teams who want to launch forks get tons of resources that make them much more likely to succeed and be safe.

Nerite’s pledge to be “Friendly”

Nerite decided to be a friendly fork and create the $USND stablecoin. We received permission to use the Liquity codebase and deploy it on Arbitrum. This was the easiest decision we ever had to make. We get tons of benefits for being friendly:

- Access to the Liquity devs who built the protocol to ask questions and for help.

- Access to a network of liquidity providers who love using Liquity based products.

- Potential for LQTY token incentives in the future.

- Assurance that if there are ever security issues in the future we are all tackling them together.

- Marketing support from the Liquity team.

- Long term alignment from the entire Liquity community and a large incentive for them to want to see us greatly succeed.

This is an insane amount of value to us.

Why a Liquity V2 fork on Arbitrum?

Why make a Liquity V2 fork on Arbitrum? Why make one at all, you might be asking. We have a few specific use cases that the protocol could support but not in its current form:

- The need for a stablecoin that is perfect for onchain treasury management on Arbitrum.

- The needs for a natively streamable stablecoin on a super fast L2.

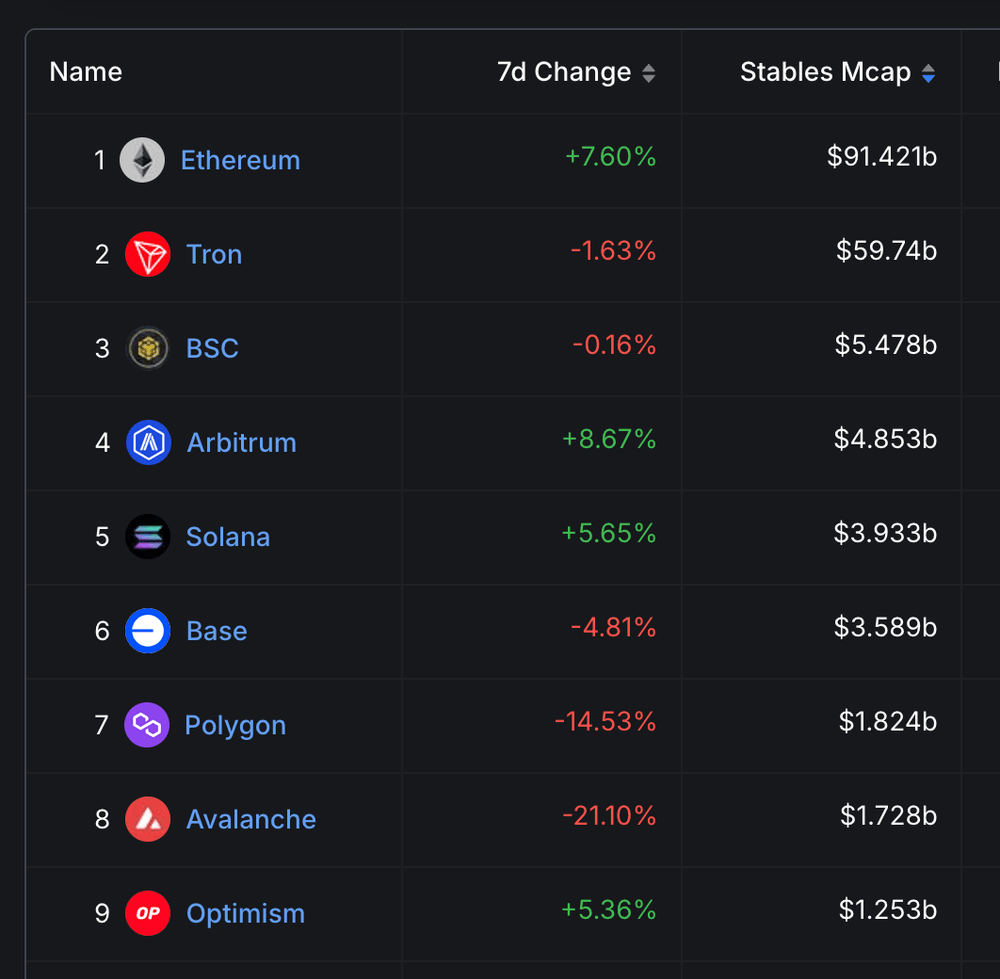

Arbitrum DAO has one of the largest treasuries of any DAO, and there are more and more onchain organizations which are managing large treasuries there. We need a crypto native decentralized stablecoin like $BOLD, but on Arbitrum and with support for the $ARB. There is a ton of demand for stablecoins on Arbitrum, and it continues to grow.

The other major change that Nerite wanted to add to the protocol is money "streaming" which was first introduced by Superfluid. It let's anyone stream $5 a month, $0.0001 per micro-second, or $10,000 a year completely linearly. Any amount, over any period of time. Imagine getting paid your salary every milisecond instead of every two weeks. Or being able to accept a stream onchain for a monthly subscription. The process for setting up streams is a bit expensive on mainnet Ethereum but only costs a few cents on Arbitrum. So it's the perfect place to try out this new usecase and see what people will build on it.

Nerite is coming soon to Arbitrum and we're so excited to be a friendly fork of Liquity.